Bonus

100% up to $250

Bonus

50% up to $200

Bonus

100% up to $122

The term ‘hedge your bet’ first came about many years ago, when George Villiers, the 2nd Duke of Buckingham, used the phrase during a play.

But, how do you hedge a bet? This term is very common in modern gambling and refers to a bet with reduced risk and potentially guaranteeing a profit.

We will explore what is hedging a bet and provide examples and leave our readers with a clear understanding of the term.

What is Hedging?

Hedging is used to reduce risk in certain situations. For example when betting and the odds have:

- Shortened after an initial bet.

- Drifted after an initial bet.

By using this strategy, bettors will minimize the risk of their bet and reduce any possibility of a nasty surprise. It’s important to take not of the odds throughout the period leading up to the payout.

Hedging Bets for Profit

The principle of placing bets on various outcomes to produce a result that pays out to the bettor regardless of whether the original bet wins or loses. This is what all bettors aspire to find when employing their own betting strategy.

Hedging a bet is only possible as we see a shift between opening and closing odds. Changes in the odds open up for hedging bets, meaning the potential loss is outweighed by the perceived gain elsewhere. This is why we see the term “Hedge fund” used on Wall Street today.

As we see in many betting systems, it’s not the perfect system. But losses can be mitigated, allowing for profits to be made, but losses can be made in numerous areas of a bet. There’s always a risk.

Examples of Hedges Bets

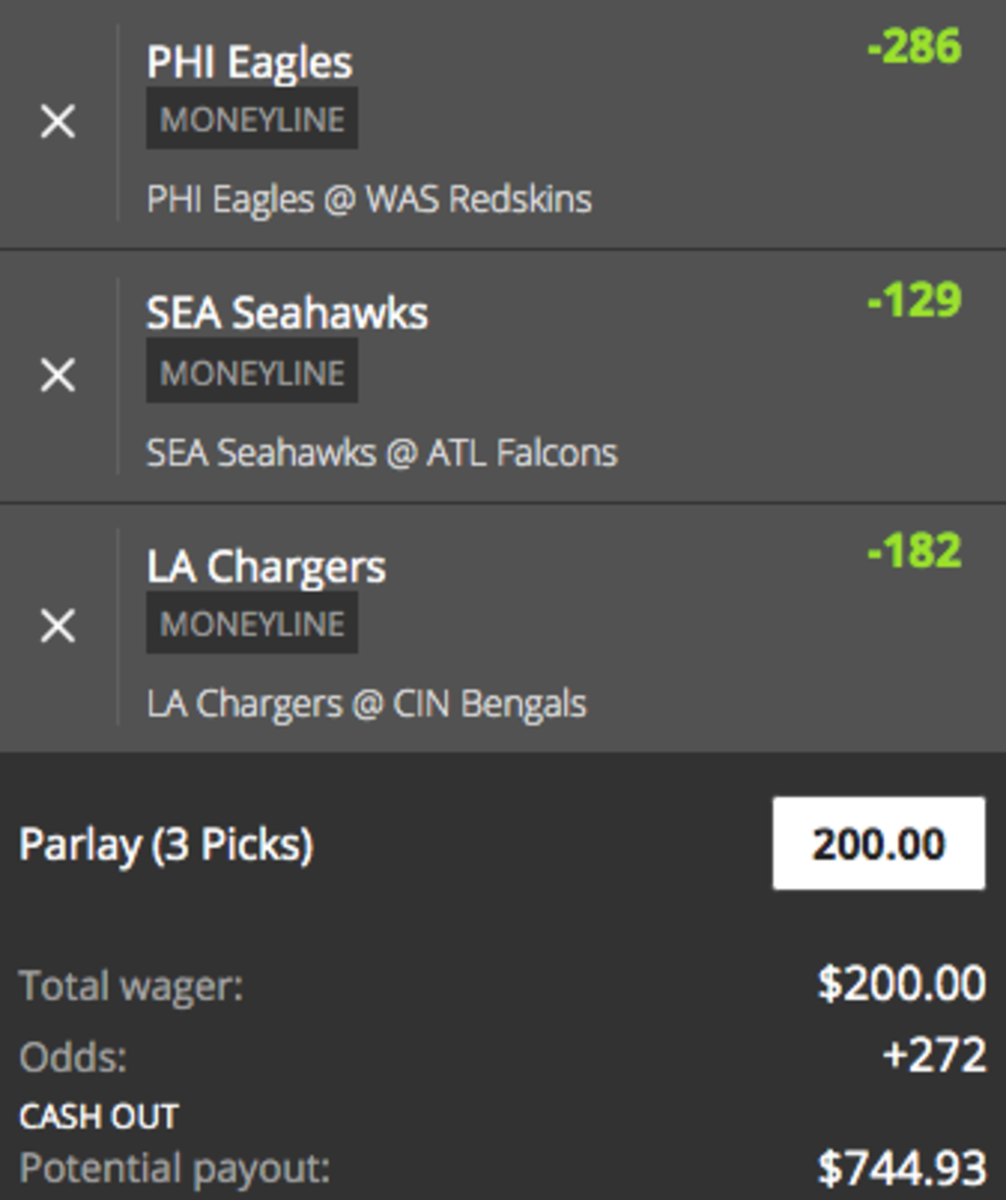

So if you’re line shopping and decide to hedge your bets on one particular market, we’d advise going with a mainstream sports market like the NFL.

- Take, for example, a bettor places $100 on the Colts to win the Super Bowl before the season begins at +350. The bettor would be in with a strong chance of winning if they made it to the Super Bowl that year.

So in this situation, the bettor is still very unlikely to win the bet, as they are still outsiders in a strong league.

- This situation presents the bettor with the opportunity to hedge their bets by backing the other Super Bowl team, the Steelers, to win the game. If the Steelers are +150 to win the title, then a $100 would yield $250.

Meaning regardless of the outcome the bettor will be making a decent profit, having hedged his bets on both teams at the Super Bowl. It’s important to remember in this situation to back the Steelers to lift the trophy, not just to win the game.

While we’ve provided examples of hedge betting for the NFL, it is common in a variety of sports. Let’s take a less common example of Champions League soccer matches.

- A bettor places $100 on Manchester United to win the Champions League as a future bet at `+350. The bettor may choose to hedge their bets on the day of the final, covering themselves by hedging their bets on the other team Bayern Munich.

How Sportsbooks Hedge bets

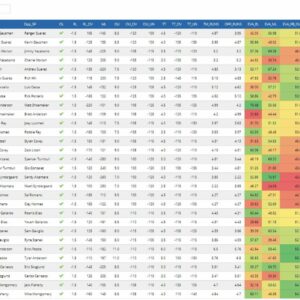

Sportsbooks are regularly hedging bets so that they can limit their risks and maximize profits. They do this by positioning themselves to make money by limiting the damage of big wins from punters.

By laying off large amounts of their liabilities, bookmakers are able to ensure that the money doesn’t flow out of their own funds – the sportsbooks bankroll management!

It acts as a kind of insurance, oddsmakers use the money they have taken in bets and use it to hedge their bets against potential losses.

Types of Hedging Bets

While we see players make hedge bet wagers all the time, there are two other ways which we will include below with examples to make things clear.

The sports betting industry is evolving and changing all the time, as such we try to ensure our readers get the full picture and know what they’re doing when they start wagering online.

Adjust Hedging

One option available to bettors is to adjust the stakes to shift the risk. Using the Super Bowl example we gave earlier, the bettor may decide to place more on the Steelers as the Colts QB is out injured.

This would obviously add weight to the stake meaning the profits on that side of the bet would be lower. A sharp is always able to find balance and weigh their bets for maximum profit.

Hedging Bets on In-Play Markets

As we mentioned before, hedging is based on movements in the market. So if the odds of a given outcome are likely to change during an event.

- Take for example the World Cup Final. If one team scores a goal early on the odds will change, allowing players to enjoy additional markets. Hedging your bets on In-Play markets is quite a popular wager to make.

This works with in-play betting markets. If the underdog scores to take the lead, the potential profit from the bet can be used to back the favorite, thus guaranteeing a return on your wager.